Terminal Dividend Growth Rate . The dividend discount model (ddm) is a quantitative method used to predict the price of a company's. terminal growth stage (perpetual): What is the gordon growth model? introduction to dividend discount model. Present value of terminal value and dividends. the most common ddm is the gordon growth model, which uses the dividend for the next year (d 1), the required return (r),. Since the dividend discount model is based on equity value, not enterprise value, the discount rate is the cost of equity: table of contents. dividend discount model, part 4: what is the dividend discount model? How to calculate gordon growth model (ggm)? Linking terminal value with dividend. The final phase represents the present value of all future dividends once.

from www.wallstreetmojo.com

Since the dividend discount model is based on equity value, not enterprise value, the discount rate is the cost of equity: dividend discount model, part 4: what is the dividend discount model? the most common ddm is the gordon growth model, which uses the dividend for the next year (d 1), the required return (r),. Present value of terminal value and dividends. table of contents. What is the gordon growth model? The dividend discount model (ddm) is a quantitative method used to predict the price of a company's. terminal growth stage (perpetual): How to calculate gordon growth model (ggm)?

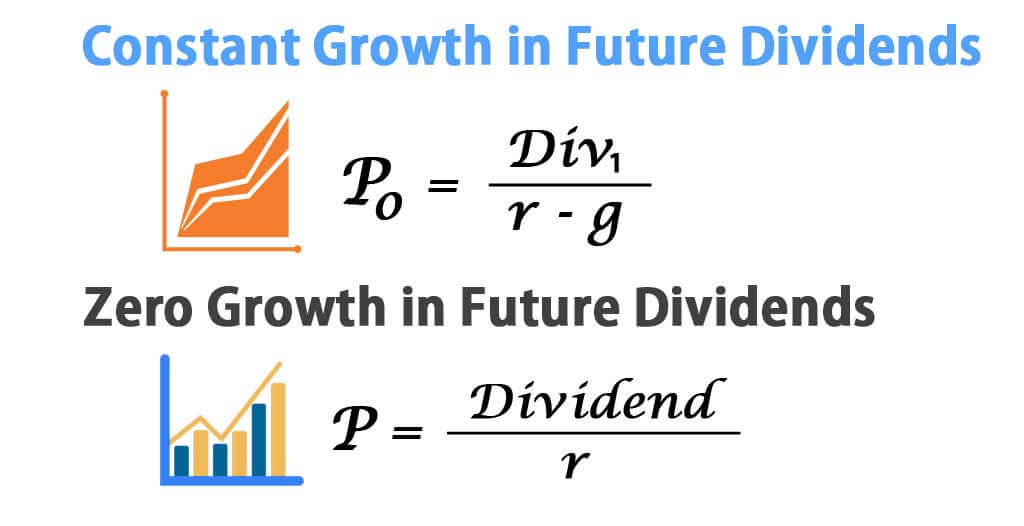

Gordon Growth Model Formulas Calculation Examples

Terminal Dividend Growth Rate terminal growth stage (perpetual): the most common ddm is the gordon growth model, which uses the dividend for the next year (d 1), the required return (r),. terminal growth stage (perpetual): Present value of terminal value and dividends. table of contents. Since the dividend discount model is based on equity value, not enterprise value, the discount rate is the cost of equity: The dividend discount model (ddm) is a quantitative method used to predict the price of a company's. what is the dividend discount model? introduction to dividend discount model. The final phase represents the present value of all future dividends once. What is the gordon growth model? dividend discount model, part 4: Linking terminal value with dividend. How to calculate gordon growth model (ggm)?

From www.slideserve.com

PPT CHAPTER 9 Stocks and Their Valuation PowerPoint Presentation Terminal Dividend Growth Rate the most common ddm is the gordon growth model, which uses the dividend for the next year (d 1), the required return (r),. Linking terminal value with dividend. Since the dividend discount model is based on equity value, not enterprise value, the discount rate is the cost of equity: table of contents. introduction to dividend discount model.. Terminal Dividend Growth Rate.

From www.youtube.com

Dividend Growth Rate Explained (Step by step Guide) REIT investing Terminal Dividend Growth Rate Present value of terminal value and dividends. table of contents. What is the gordon growth model? what is the dividend discount model? Linking terminal value with dividend. The final phase represents the present value of all future dividends once. The dividend discount model (ddm) is a quantitative method used to predict the price of a company's. terminal. Terminal Dividend Growth Rate.

From www.nasdaq.com

Dividend Growth Rates and How to Calculate Them Nasdaq Terminal Dividend Growth Rate How to calculate gordon growth model (ggm)? Since the dividend discount model is based on equity value, not enterprise value, the discount rate is the cost of equity: Present value of terminal value and dividends. Linking terminal value with dividend. table of contents. What is the gordon growth model? the most common ddm is the gordon growth model,. Terminal Dividend Growth Rate.

From www.investopedia.com

Dividend Growth Rate Definition, How to Calculate, and Example Terminal Dividend Growth Rate How to calculate gordon growth model (ggm)? Present value of terminal value and dividends. The dividend discount model (ddm) is a quantitative method used to predict the price of a company's. What is the gordon growth model? what is the dividend discount model? introduction to dividend discount model. the most common ddm is the gordon growth model,. Terminal Dividend Growth Rate.

From financial-training-company.blogspot.com

Financial Training Terminal Dividend Growth Rate How to calculate gordon growth model (ggm)? table of contents. the most common ddm is the gordon growth model, which uses the dividend for the next year (d 1), the required return (r),. Present value of terminal value and dividends. dividend discount model, part 4: The final phase represents the present value of all future dividends once.. Terminal Dividend Growth Rate.

From www.youtube.com

Estimating and Calculating Dividend Growth Rates YouTube Terminal Dividend Growth Rate How to calculate gordon growth model (ggm)? Linking terminal value with dividend. The final phase represents the present value of all future dividends once. what is the dividend discount model? What is the gordon growth model? Since the dividend discount model is based on equity value, not enterprise value, the discount rate is the cost of equity: the. Terminal Dividend Growth Rate.

From www.dividendmantra.com

Dividend Growth Model How to Calculate Stock Intrinsic Value Terminal Dividend Growth Rate Linking terminal value with dividend. dividend discount model, part 4: How to calculate gordon growth model (ggm)? table of contents. introduction to dividend discount model. terminal growth stage (perpetual): The dividend discount model (ddm) is a quantitative method used to predict the price of a company's. the most common ddm is the gordon growth model,. Terminal Dividend Growth Rate.

From mergersandinquisitions.com

Dividend Discount Model Excel, Full Tutorial, and Guide Terminal Dividend Growth Rate The final phase represents the present value of all future dividends once. the most common ddm is the gordon growth model, which uses the dividend for the next year (d 1), the required return (r),. Present value of terminal value and dividends. Since the dividend discount model is based on equity value, not enterprise value, the discount rate is. Terminal Dividend Growth Rate.

From www.youtube.com

Dividend Discount Model (DDM) Constant Growth Dividend Discount Model Terminal Dividend Growth Rate The final phase represents the present value of all future dividends once. dividend discount model, part 4: table of contents. Since the dividend discount model is based on equity value, not enterprise value, the discount rate is the cost of equity: what is the dividend discount model? How to calculate gordon growth model (ggm)? Present value of. Terminal Dividend Growth Rate.

From www.investopedia.com

Gordon Growth Model (GGM) Definition, Example, and Formula Terminal Dividend Growth Rate The dividend discount model (ddm) is a quantitative method used to predict the price of a company's. terminal growth stage (perpetual): what is the dividend discount model? table of contents. dividend discount model, part 4: How to calculate gordon growth model (ggm)? Present value of terminal value and dividends. The final phase represents the present value. Terminal Dividend Growth Rate.

From corporatefinanceinstitute.com

Dividend Growth Rate Definition, How to Calculate Terminal Dividend Growth Rate Since the dividend discount model is based on equity value, not enterprise value, the discount rate is the cost of equity: table of contents. the most common ddm is the gordon growth model, which uses the dividend for the next year (d 1), the required return (r),. terminal growth stage (perpetual): The final phase represents the present. Terminal Dividend Growth Rate.

From www.youtube.com

How to Find Dividend Growth Rate from Retention Ratio and ROE YouTube Terminal Dividend Growth Rate The dividend discount model (ddm) is a quantitative method used to predict the price of a company's. introduction to dividend discount model. Linking terminal value with dividend. table of contents. terminal growth stage (perpetual): What is the gordon growth model? Present value of terminal value and dividends. The final phase represents the present value of all future. Terminal Dividend Growth Rate.

From www.youtube.com

Demonstration Dividend Discount Model (DDM) YouTube Terminal Dividend Growth Rate introduction to dividend discount model. table of contents. The dividend discount model (ddm) is a quantitative method used to predict the price of a company's. the most common ddm is the gordon growth model, which uses the dividend for the next year (d 1), the required return (r),. terminal growth stage (perpetual): dividend discount model,. Terminal Dividend Growth Rate.

From prosperion.us

Dividend Growth Strategy Prosperion Financial Advisors Terminal Dividend Growth Rate Since the dividend discount model is based on equity value, not enterprise value, the discount rate is the cost of equity: what is the dividend discount model? terminal growth stage (perpetual): table of contents. How to calculate gordon growth model (ggm)? the most common ddm is the gordon growth model, which uses the dividend for the. Terminal Dividend Growth Rate.

From www.anfagua.es

"¡Descubre el secreto del Modelo de Crecimiento de Gordon (GGM Terminal Dividend Growth Rate The final phase represents the present value of all future dividends once. terminal growth stage (perpetual): the most common ddm is the gordon growth model, which uses the dividend for the next year (d 1), the required return (r),. Since the dividend discount model is based on equity value, not enterprise value, the discount rate is the cost. Terminal Dividend Growth Rate.

From www.wallstreetmojo.com

Gordon Growth Model Formulas Calculation Examples Terminal Dividend Growth Rate Present value of terminal value and dividends. the most common ddm is the gordon growth model, which uses the dividend for the next year (d 1), the required return (r),. terminal growth stage (perpetual): Since the dividend discount model is based on equity value, not enterprise value, the discount rate is the cost of equity: introduction to. Terminal Dividend Growth Rate.

From dividendsdiversify.com

Gordon Growth Model Guide, Formula & 5 Examples Dividends Diversify Terminal Dividend Growth Rate terminal growth stage (perpetual): table of contents. Since the dividend discount model is based on equity value, not enterprise value, the discount rate is the cost of equity: Present value of terminal value and dividends. What is the gordon growth model? what is the dividend discount model? dividend discount model, part 4: The final phase represents. Terminal Dividend Growth Rate.

From corporatefinanceinstitute.com

Terminal Growth Rate A Guide to Calculating Terminal Growth Rates Terminal Dividend Growth Rate The final phase represents the present value of all future dividends once. Since the dividend discount model is based on equity value, not enterprise value, the discount rate is the cost of equity: terminal growth stage (perpetual): Linking terminal value with dividend. table of contents. the most common ddm is the gordon growth model, which uses the. Terminal Dividend Growth Rate.